VAT

Here you can define various VAT Groups (depending on the type of products that are sold on your Shop). For instance, electronic items may not have the same VAT rate as fine food.

Each VAT Group consists of a set of rules, which enables you to specify the VAT rate according to the "From" country (from which the goods are sent) and "To" country (where the goods will be delivered).

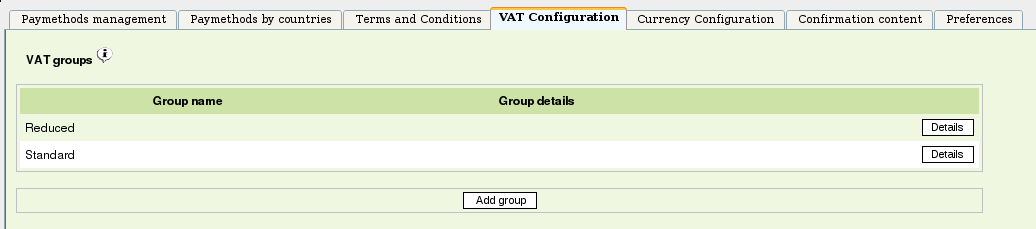

1. VAT Groups List

This is the default view of the "VAT Configuration" tab of the Billing Management module:

All VAT Groups that are setup in your company are listed here. Each of them can be configured by clicking on the corresponding "Details" button.

To add one, click on the "Add group" button below the list.

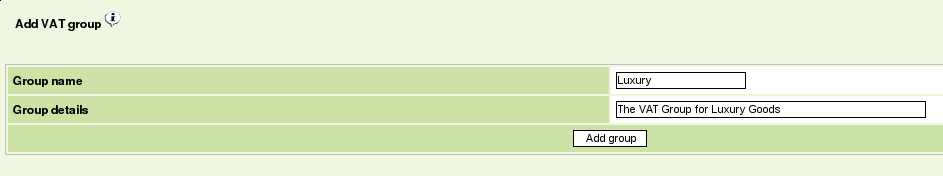

2. Creating a VAT Group

Let's assume that luxury products have a specific VAT rate. We would have to create a VAT group such as this one :

Just enter a name and a short description, then click "Add group". The "Rules" section appears.

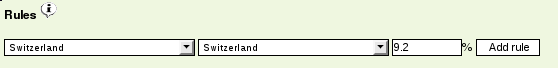

3. Editing VAT Rules

To add a rule, choose a "From" and "To" country using the drop-down lists, then enter the corresponding percentage. For instance, we'll assume that our Shop is located in Switzerland and that Swiss customers have to pay 9.2% VAT on Luxury Goods.

Once the values are correct, click on "Add rule" to make it effective. The newly added rule now appears in the VAT Rules list :

In our example, let's now suppose that our company has multiple shops in many countries. We may want to define a default VAT rate for any other countries. To do so, create another rule using the * ("Star") symbol as From country and To Country.

Note: If no matching VAT rule is found, the system assumes that the VAT rate is 0%